PER DIEM LOOK-UP

1 Choose a location

OR

OR

Rates for Alaska, Hawaii, and U.S. territories and possessions are set by the Department of Defense.

Rates for foreign countries are set by the Department of State.

An official website of the United States government

Here’s how you know

Official websites use .gov

A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS

A lock

( )

or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

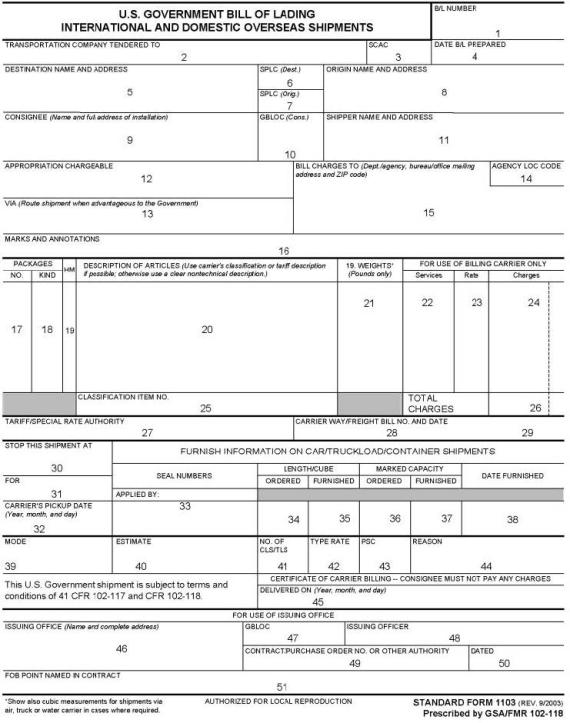

Download SF 1103 U.S. Government bill of lading [PDF, 309kb]

The sample SF 1103 below contains numbers in each area of the form to be completed. Instructions below are numbered accordingly.

Enter a BOL number. Each BOL number is unique.

See Obtaining and creating BOL numbers, Chapter 7 for information on BOL numbers.

Enter the full business name of the initial line-haul TSP to which the shipment is tendered. The business name should include the words “Company,” “Incorporated,” or “Limited,” as appropriate. (These words may be abbreviated as Co., Inc., and Ltd.) No other company or TSP abbreviation, initial, or symbol may be used.

If a different TSP actually picks up the shipment, the name of the pickup TSP should be indicated in parentheses following the name of the origin line-haul TSP.

For shipments tendered to TSPs under the our Centralized Household Goods Traffic Management Program (civilian agencies only), enter the name of the transportation company that is party to a GSA Tender of Service Agreement.

Enter the origin line-haul TSP’s four letter Standard Carrier Alpha Code.

SCACs are a means of TSP identification and must be included on bills of lading. These codes are an integral part of the government’s transportation management system.

SCACs are assigned by the National Motor Freight Traffic Association, Inc for all TSPs except railroads. All SCACs are listed in the Directory of Standard Carrier Alpha Codes.

TSPs may request a SCAC online or by writing to:

NMFTA

1001 North Fairfax Street, Suite 600

Alexandria, VA 22314

Railroad companies should write to:

Association of American Railroads

50 F Street, NW

Washington, DC 20001-1564

Enter the date the first entry is made on the BOL.

Enter the final destination point where the TSP is to make actual delivery of the shipment to the consignee. Use the complete address (name of federal activity, street address, city, town or point, state and ZIP Code or country) and commercial telephone number.

If there are two or more cities or towns of the same name in the same state, the name of the county must be shown in addition to the city or town and state.

Include any additional information that will ensure shipment delivery to the specified destination. For example, gate entrance, building or warehouse number, bus terminal, station identification, railroad team track, or private siding within the limits of which the consignee receives carload freight. If space is insufficient, add the words “See Marks and Annotations” and insert the information in the MARKS AND ANNOTATIONS space.

Civilian agencies may disregard these spaces.

Enter the nine-digit Standard Point Location Code for a shipment’s origin and destination as published in applicable TSP tariffs and tenders. These codes must be on all bills of ladings issued by the Department of Defense. SPLC numbers are listed in the Continental Directory of Standard Point Location Codes, published by the National Motor Freight Traffic Association, Inc.

Enter the exact shipping point where shipment originates. Include the complete street address, city, town or metropolitan area, state and ZIP Code.

Complete information is necessary because shipping points, railheads, or billing stations are not always located in the same place. When there are several TSP stations within or adjacent to a metropolitan area, insert the full name of the city and state and the full name of the station or street address, including the ZIP Code where the shipment is tendered.

Enter the full name and title, room number, and mailing address, including ZIP Code of the department, activity, and person designated to receive the shipment at its final destination. Only one consignee should be listed in this space. When the person to be notified of the delivery differs from the consignee, the name of the person to be notified should also be shown, preceded by the word “Notify.”

When the shipment is consigned for delivery to a person or location other than the mailing address shown, add the words, “See Marks and Annotations” and insert an explanation in the MARKS AND ANNOTATIONS space (#16).

Civilian agencies may disregard this space.

The GBL Office Code should be completed on all DOD GBL’s, including GBLs converted from CBL’s.

Enter the GBLOC which identifies the military installation, activity or office that is the consignee for the shipment. The common code “1001” should be entered if the consignee has not been assigned a GBLOC.

GBLOCs assigned to DOD activities/shippers are listed in the Defense Transportation Regulation DOD Regulation 4500.9-R [PDF, 320KB].

Enter the proper name, address, and ZIP code of the government shipping activity authorizing and responsible for the shipment. Initials or abbreviations of the activity should only be used when absolutely necessary.

When a BOL is furnished to a contractor to make a shipment that has been authorized by a government activity, the full name of that contractor should also be shown. In this case, the following statement must be added after the contractor’s name: “For the account of” or “A/C” and the name of the government activity authorizing the shipment.

Enter the complete Government appropriation against which the cost of transportation is to be charged.

When more than one appropriation is involved, each item or weight should be referenced to the proper appropriation, and the total for each account should be inserted in this space. If more additional space is required, use the MARKS AND ANNOTATIONS or DESCRIPTION OF ARTICLES space on the GBL or SF 1109, U.S. Government bill of lading continuation sheet, and cross-reference the appropriation chargeable space.

Example:

| 0.117.7.39139.522 | 1750 | $152.07 |

| 0.117.7.39139.528 | 1080 | $ 93.86 |

| 0.117.7.39139.535 | 6 | $ .52 |

This space should usually be left blank. The origin TSP is obligated to forward shipments over a route which will provide the lowest published charges within the mode.

Enter the complete routing for carload quantities via rail, or equivalent quantities via motor or water, only when some substantial interest of the government is served thereby. If there is insufficient space to show the full name of each TSP in the route, authorized initials or abbreviations may be used. Junction or interchange points should not be used unless they are required by tender or tariff.

Routings should be selected by experienced transportation personnel who are aware of various tariff restrictions and limitations. This will ensure that required transportation services are obtained at the lowest possible cost to the government.

Routing instructions on the BOL must be correct and legible. When there is doubt regarding the most advantageous route, do not specify TSP(s).

When a rail switching TSP is required to complete delivery at destination, the authorized initials or abbreviations of the name of the switching TSP should be shown in parentheses next to the initials of the road or line-haul TSP, followed by the words “Switch Delivery”.

VIA (Route shipment when advantageous to the government)

CR-RFP-CSXT (NS). Switch Delivery

Classified and Sensitive Material

(DOD activities only)

VIA (Route shipment when advantageous to the Government)

SUBSTITUTE SERVICE NOT TO BE USED: CCOI 42011

For all motor movements of classified and sensitive material, annotate “Substitute service not to be used.”

Enter the complete name and correct mailing address, including the ZIP code, of the office that will pay and/or authorize the transportation charges. The TSP’s bill, together with the original BOL properly certified by the TSP, will be forwarded to the name and address shown in this space. Initials or abbreviations of the federal activity should only be used when absolutely necessary.

When more than one office is responsible for payment of charges, enter the name and address of the disbursing office accountable for the largest portion of weight listed on the BOL.

DOD activities may disregard this space.

BOLs involving shipments for civilian agencies should also have an Agency Location Code entered in this space. ALCs are assigned in accordance with procedures in the Treasury Financial Manual for Guidance of Departments and Agencies, Volume 1, Part 2, Section 3320. The ALC to be used should be obtained from the agency’s local finance or accounting officer.

This space should be filled out when special marks or identifying symbols are used on packages or boxes comprising the shipment. Special marks assist in handling, accounting, and storing, and serve other useful purposes after the shipment has been delivered.

Supplemental data may also be entered in this space when space in other spaces is insufficient. When used for this purpose, data should be cross-referenced to the appropriate space.

When shipments are intended at the destination for some person other than the consignee or for trans-shipment, insert the word “For” followed by the name or code, if applicable, of the person or activity to whom the delivery is to be made.

When a shipment is made to a port of export, insert the words “For Export,” and follow with the name of the destination country.

When accessorial or special services are ordered incident to the line-haul transportation, the BOL must be endorsed to show the name of the TSP upon which the request was made and the kind and special services ordered. The endorsement may be placed in this space or on SF 1109 and signed by or for the person who ordered the service.

If additional space is required, special notations may be entered on SF 1109 and cross- reference in this space.

Kind

These spaces should show the total number of each type of package applicable to each group of articles opposite the related description of such articles as shown in the DESCRIPTION OF ARTICLES space (#20).

A separate entry must be made for each article that is classified differently. Each type of container or package used, such as barrels, boxes, crates, drums, or cylinders, must be shown. Customary abbreviations may be used to describe the type of container used in the shipment. Generally, only the type of outer container or package is entered in this space, since inner containers or packages do not determine the classification rating or the freight rate.

Household goods

(Civilian agencies only)

Enter “1 LOT” in this space.

When articles are shipped on pallets, the number of packages comprising the pallet load must be shown (e.g., 2 pallets of 20 boxes each; 1 bundle of 4,000 board feet).

If articles are shipped loose, the number of pieces or units and the related description of such articles should be entered.

When carload shipments of bulk freight such as coal, ore, gravel, sand, or loose grain are made, this space should be disregarded.

Enter an “X” if the shipper is requesting transportation for any hazardous materials subject to the Department of Transportation Regulations (Title 49, Code of Federal Regulations). Then list the hazardous material(s) under DESCRIPTION OF ARTICLES (#20).

Enter the proper freight description and any other information or special instructions to the TSP concerning the items being shipped. When freight items are subject to a released valuation, such released valuation must be shown on the BOL.

The information in this space should conform to the governing TSP’s classification, tender or tariff description. The description of articles provided in the TSP’s freight classification determines the freight rate to be applied.

If there is doubt concerning the proper description, a clear, non-technical description should be placed in this space. Trade names may be added in parentheses to the description if it will aid in proper classification of the commodity shipped. It is important that “used” articles or property be so designated in the description of articles.

SF 1109, should be used if additional space is needed to complete the description of articles to be shipped.

Rail or motor commodity descriptions should not be used for water shipments, unless so provided in the TSP’s tariff.

When shipping the hazardous materials listed in 49 CFR 172.101, the description must be shown as listed therein. If the hazardous material description differs from the governing applicable rate authority description, the hazardous material description, including the appropriate United Nations number, must be shown first, and immediately behind it in parentheses, the applicable rate authority description. The hazardous class number must be shown on all international shipments. Abbreviations must not be used. When both a hazardous material and a non-hazardous material are listed, the hazardous material must be shown first or entered in a contrasting color.

Since hazardous materials regulations are subject to change, it is recommended the U.S. Department of Transportation’s Hazardous Materials Regulations (49 CFR, Parts 171 through 180) be reviewed prior to such shipments. The U.S. Department of Transportation, Pipeline and Hazardous Materials Safety Administration is responsible for coordinating a national safety program for the transportation of hazardous materials by air, rail, highway, and water. PHMSA Internet Web site, http://www.phmsa.dot.gov/hazmat, is designed to disseminate information about the agency’s programs and activities and to assist in complying with the Hazardous Materials Regulations.

The following certification, as required by 49 CFR 172.204, should also be included in the descriptions of articles space, when hazardous materials are shipped by conveyances other than air TSPs:

“This is to certify that the above-named materials are properly classified, described, packaged, marked, and labeled, and are in proper condition for transportation, according to the applicable regulations of the Department of Transportation.”

__________________

Certifying official

Shipments via air TSPs require the following certification:

“I hereby certify that the contents of this consignment are fully and accurately described above by proper shipping name and are classified, packed, marked and labeled, and in proper condition for carriage by air according to applicable national governmental regulations.”

__________________

Certifying official

These certifications must be legibly signed by a principal, officer, partner, or employee of the shipper or his agent. The signature may be manually produced by typewriter, or by other mechanical means.

When civilian agencies move household goods on a SF 1103, the words HOUSEHOLD GOODS AND PERSONAL EFFECTS, the pickup date(s), required delivery date(s), released value of the shipment, and storage in transit authorization should be entered in this space.

If professional books, papers and equipment are authorized to be shipped in the same lot with the household goods, the BOL must be annotated with a statement concerning PBP&E with estimated weight, separate administrative appropriation chargeable, and a request that PBP&E be packed and weighed separately. (See our guide: Shipping Your Household Goods Employee Guide which can be downloaded in pdf format from https://www.gsa.gov/travel/agency-services/relocation/household-goods-transportation. Once you reach the website, click on the following links to the left: Household Goods Transportation.

The following additional information or instructions may also be included:

A shipment is made at a restricted or limited valuation specified in an applicable rate authority or under which the lowest rate is available, unless otherwise indicated on the face of the bill of lading. When freight descriptions are based on released valuation and shipping declaration is required, the BOL should be annotated as follows:

“Released valuation not exceeding _______(value)_______ per _______(unit of weight)_______,”

or simply;

“RVNX _______(value)_______ per _______(unit of weight)_______,”

Cite the approving authority for declaring excess valuation on high value material, if such valuation is necessary. Intermodal shipments require a separate notation for each mode of transportation because released valuations may differ for each mode.

The gross weight of the package(s) must be shown separately in the weight column opposite the appropriate description of the package(s) in the DESCRIPTION OF ARTICLES space.

The weight of pallets, platforms, or skids on which a shipment may be loaded should be shown separately on the BOL because some TSP tariffs provide that no charge will be made for their weight when it is shown separately.

When continuation sheets are required for separate listings of all packages, their total weight should be shown on the original BOL with a reference to the continuation sheet.

Weights are specified as “actual,” “estimated,” or “agreed.” When “agreed” weights are used, reference to the weight agreement and the name of the issuing bureau should be shown on the original BOL. When actual weights cannot be determined before the shipment is made, estimated weights should be shown and the notation “Estimated weights; weigh and correct” should be placed on the BOL.

When property is shipped in truckload, carload or equivalent quantities, and dunnage, such as blocking, temporary lining, racks, bracing, or strapping is required; the weight of the dunnage must be shown separately. Provisions for dunnage allowances vary under the applicable tariffs.

TSPs generally require the shipment weight in order to figure the shipping cost, however some shipments will be based on dimensional pricing. The weight provided must include all packaging materials (box, pallet, shrink wrap, etc). A TSP also requires the shipping weight in order to maintain compliance with regulatory weight restrictions. TSPs may reweigh your shipment to enforce compliance with regulatory weight restrictions. Since TSP’s freight charges are based primarily on weight, it becomes a controlling factor in the efficient and economical expenditure of government transportation funds.

*Show cubic measurements for shipments via air, truck or water in cases where required.

This section is for the sole use of the billing TSP who inserts the services provided and the proper rates and charges.

This section is left blank on the original and all copies furnished to the TSP. The issuing officer may use this space to show estimated transportation charges and such accounting classifications as may be administratively required.

Enter the Uniform Freight Classification or the National Motor Freight Classification number for the article described on the BOL. When the shipment consists of more than one commodity, the classification number should be shown after each commodity listed in the DESCRIPTION OF ARTICLES space.

This space can then be left blank. When the commodity description is “Freight of All Kinds,” the appropriate number shown in the applicable Government freight tender or rules publication governing the movement of freight traffic should be used.

For carload, truckload, container, or volume shipments enter the tariff reference or special rate quotation under the provisions of 49 U.S.C. 10721, 13712, and 15504. This reference is entered as a source of information; an audit of charges will not be limited to what is referenced.

When special rate quotations provide a reduction in transportation costs for shipments, regardless of their weight, including less-than-carload quantities, these rate authorities should be indicated. One time only quotes and rate agreements should be shown and copies attached to the BOL. Use the TSP’s standard carrier alpha code followed by the tariff or rate quotation number.

The TSP should transfer their way or freight bill number to this space and provide the date prior to billing for charges. This information is useful to the shipper and consignee for tracing and claims purposes.

Rail and motor TSP tariffs generally provide stop off-in-transit to partially load or unload shipments. This TSP service permits a conveyance to be stopped at one or more intermediate points during transit for the purpose of loading or unloading freight prior to arrival at the final destination. Charges are based on the total maximum weight shipped from original point of origin to final destination plus the stop off charges. Combining several shipments moving to or from the same general geographical area often results in lower overall transportation costs.

It is important that complete instructions are provided to the TSP on the BOL to ensure that all parties involved with such shipments are aware of the special loading or unloading requirements.

When a shipment is to be stopped in transit for partial loading or unloading, the following information must be fully and completely shown on the BOL:

If this space does not provide enough room, additional information may be shown in the MARKS AND ANNOTATIONS, DESCRIPTION OF ARTICLES (#20), or on SF 1109. Appropriate cross-reference should be made in this space.

Each portion of the shipment to be partially loaded or unloaded at intermediate points should be identified in the DESCRIPTION OF ARTICLES space.

Inclusion of the above details concerning the material to be stopped in transit will enable TSPs to perform the service with a minimum of delay.

It is also necessary that each intermediate consignee at the stop off points is notified promptly of the shipment. This may be accomplished by the consignor forwarding a copy of the BOL to the intermediate consignees at the time the shipment is tendered to the origin TSP.

Under the GBL distribution procedures where the original SF 1103 is furnished to the origin TSP at the time of shipment, the intermediate consignee at the stop off point will issue a certificate to the stop off TSP and furnish copies to any other intermediate consignee and the final consignee. This certificate will provide specific details concerning the material loaded or unloaded at the stop off locations (GBL number, conveyance number, final destination, seal numbers, stop off points, portion of shipment loaded or unloaded, date of stop off and any loss, damage, or other discrepancies noted at the time the shipment is received at the stop off point).

Each consignee who discovers losses, damages, or other discrepancies should report them to the transportation office or other designated offices, as required by the agency issuing the BOL.

Civilian agencies only

If the SF 1103 is used for a household goods shipment and there is to be a pickup in addition to the one at the origin residence, the extra pickup address should be entered in the STOP THIS SHIPMENT AT space and the words “Extra Pickup” should be entered in this space.

If a delivery is to occur in addition to that at the final destination residence or warehouse, the extra delivery address should be entered in the STOP THIS SHIPMENT AT space and the words “Extra Delivery” should be entered in this space.

The TSP to whom the shipment is tendered must complete this space. The BOL is legally in effect and the TSP assumes responsibility for the shipment when it takes physical possession of the shipment.

The applicable rate on any shipment is the one published and in effect on the date the shipment is accepted by the TSP. If the published rate or other rates, including fuel surcharges, are adjusted while the shipment is en route, the TSP’s acceptance date determines which rate applies.

When a shipment is made in one or more closed rail cars, closed motor vehicles, or containers and these commercial conveyances are sealed at the point of origin, this space should show each of the seal numbers and who applied them (shipper for rail cars and intermodal containers; shipper or TSP for motor vehicles). When shipments are made by commercial conveyance, the TSP has access to equipment during transit, even if seals are applied. If motor vehicles are loaded to full visible capacity, they should be sealed by the shipper. Seals are applied to protect the cargo in transit from pilferage or damage. Sealing of a truck does not trigger application of exclusive use vehicle rates.

A record of the original seal numbers assists in determining liability when equipment arrives at the destination with broken or missing seals or when loss, damage, or shortage is subsequently discovered in the shipment. Any changes from the original seal numbers should be noted by the consignee on his copy of the delivering TSP’s documents and the consignee’s copy of the BOL, if available. All notations must be signed by the consignee and the TSP’s agent.

These spaces must be completed when a railcar, truck, or container of a specific length or cubic capacity is ordered to accommodate a shipment. The information is required to ensure that the lowest freight charge will be applied to the shipment.

Enter the length (in feet and inches) or cubic feet of railcar (TSP or government-owned), motor vehicle, container, or barge ordered and furnished.

When carload, truckload, or containerized shipments are involved, TSPs cannot always furnish equipment of the length and cubic capacity ordered. They may furnish units of greater length and cube. If the BOL does not show the length and cubic capacity of the conveyance ordered, charges will be assessed on the minimum weight or cube applicable to the conveyance furnished and used. If the BOL shows a conveyance smaller than that furnished was ordered, charges will usually be based on the size of the smaller conveyance, unless otherwise provided by TSP tariff or other governing publication.

This space should not be completed when less-than-truckload shipments are involved, unless required by tariff or tender.

If a TSP indicates prior to furnishing the conveyance that he does not have the size ordered and offers one of a greater size or capacity, the larger size conveyance may be accepted if the TSP is willing to have the BOL annotated:

“This size conveyance furnished for the convenience of the TSP”

This notation will generally protect the minimum weight or cube for the conveyance ordered.

Warning: If a shipper permits the loading of his shipment on equipment provided by the TSP which is different than the one he ordered, that constitutes acceptance of the equipment provided, and charges will be assessed on the basis of the equipment actually used.

When one or more railcar or container is ordered for a shipment, or when exclusive use of a vehicle is required, enter the desired capacity, and if available, the marked capacity of the equipment such as pounds and/or cubic feet.

Loading rail freight cars is normally the responsibility of the shipper. Care should be exercised to prevent overloading when heavy commodities are involved, as unloading or reloading excess weight is quite costly.

Disregard this space when shipments are made in less-than-truckload quantities.

This space must be completed when the shipment comprises one or more carloads, truckloads, or containers.

“DATE FURNISHED,” means the date on which the conveyance is placed in a satisfactory condition for loading.

The date on which a conveyance is furnished serves as a basis for determining the application of demurrage or detention charges and will govern the free time allowed for loading and/or unloading. Omission of this date could result in the payment of erroneous demurrage or detention charges.

When shipments are by ship or barge, it is also important to show the date the vessel is available for loading.

Disregard this space when shipments are made in less-than-truckload quantities.

Enter the type of transportation used for the shipment (motor, rail, air) or identify any special type of conveyance used to transport the shipment (boxcar, flatbed trailer, etc.).

For DOD Shipments Only

Use specific codes assigned for entry in these spaces. Codes are published in the DTR.

Enter the estimated transportation cost for the shipment, if required by the issuing agency.

Enter the number of conveyances used. Cross out conveyance not used. (Disregard this space for less-than-truckload quantities.)

Enter the type of rate used for the shipment (class, commodity, Sections 10721, 13712, 15504, contract, or mileage). If space is insufficient use the MARKS AND ANNOTATIONS space (#16) or see GENERAL INSTRUCTIONS AND ADMINISTRATIVE DIRECTIONS below if additional space is necessary.

For DOD Shipments Only

Use specific codes assigned for entry in these spaces. Codes are published in the Defense Transportation Regulations.

Shipments requiring transportation protective services during transit must show the appropriate PSC shown in the applicable Government rules publications governing the shipment.

For DOD Shipments Only

Use specific codes assigned for entry in these spaces. Codes are published in the DTR.

For DOD Shipments Only

If a shipment cannot be sent via the lowest cost route, enter the appropriate reason code and the difference in cost in this space.

Specific codes assigned for entry in this space are published in the DTR.

This space certify that the TSP has performed the services required by the BOL and must be completed by the delivering TSP before the government pays the charges.

For use of issuing office

Enter the complete name and mailing address of the BOL issuing office.

When GBL continuation sheets are used, the full name and complete mailing address of the issuing office must be shown in the space provided.

The issuing office is accountable for misuse, loss, or cancellation of a BOL. Therefore, the specific office issuing the BOL, as well as the department or agency, must be shown.

For DOD Shipments Only

Enter the government bill of lading office code assigned to the issuing activity.

Enter the typed or stamped name and title of the issuing officer. A manual or facsimile signature of the issuing officer’s name is not required in this space except when issuing laser printed GBLs or when individual agency requires signature. When issuing laser printed GBLs, each original should be signed in a color or ink other than black.

Your agency’s policy will determine who may issue GBLs. Regardless of whether it is used by the issuing activity or by a contractor as shipper, only the name of the issuing officer or his authorized alternate is acceptable. Although the signature of the issuing officer is not required in this space, except as provided above, his typed name and title must appear on the original and all copies of the GBL. Therefore, if a facsimile name and title stamp is used, each copy of the GBL set must be individually stamped.

Enter the number of the procurement document, contract or purchase order number, or other authority for making the shipment.

When one BOL covers several lots of material with each lot under a different shipping authority, reference each shipping authority in connection with the description of the respective item or groups of items shown in the consignee space.

For household goods shipments (civilian agencies only), enter the travel authorization number.

When the BOL is to be used by a contractor as shipper, it is particularly important that the issuing officer furnish the contractor with the contract or purchase order number, or other authority for shipment, its date, and f.o.b. point. In the absence of such data on a BOL, the TSP may refuse to accept the shipment from a contractor as shipper.

Enter the date of the contract, purchase order, or other authority.

For household goods shipments (civilian agencies only), enter the date the relocation travel authorization was signed.

Enter the FOB of shipment named in the procurement document.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, and U.S. territories and possessions are set by the Department of Defense.

Rates for foreign countries are set by the Department of State.

Rates are available between 10/1/2022 and 09/30/2025.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

An SBA program that helps provide a level playing field for small businesses owned by socially and economically disadvantaged people or entities that meet the following eligibility requirements:

See Title 13 Part 124 of the Code of Federal Regulations for more information.

From 5 USC 5701(6), "continental United States" means the several states and the District of Columbia, but does not include Alaska or Hawaii.

A multiple-award IDIQ governmentwide acquisition contract offering complete and flexible IT solutions worldwide. A best-in-class GWAC and preferred governmentwide solution, Alliant 2 offers:

It provides best-value IT solutions to federal agencies, while strengthening chances in federal contracting for small businesses through subcontracting.

A dedicated, flexible fuel, or dual-fuel vehicle designed to operate on at least one alternative fuel.

An investment in our nation’s infrastructure and competitiveness. The law provides funding for LPOE modernization projects that will create new good-paying jobs, bolster safety and security, and make our economy more resilient to supply chain challenges.

An agreement established by a government buyer with a Multiple Award Schedule contractor to fill repetitive needs for supplies or services.

Types of funds to use on specific expenses.

The work done to make a structure or system ready for use or to bring a construction or development project to a completed state.

Negotiated firm-fixed pricing on airline seats for official government travel. The locked-in ticket prices for the fiscal year save federal agencies time and money. Federal employees enjoy flexibility to change their plans without incurring penalties or additional costs. All negotiated rates have:

Use the CPP search tool to find current fares.

A space where individuals work independently or co-work collaboratively in a shared office. The work environment is similar to a typical office, usually inclusive of office equipment and amenities. Typical features of co-working facilities include work spaces, wireless internet, communal printer/copier/fax, shared kitchens, restrooms and open seating areas. May also be referred to as a “shared office.”

A system that is bought from a commercial vendor to solve a particular problem, as opposed to one that a vendor custom builds.

An employee who negotiates and awards contracts with vendors and who has the sole authority to change, alter or modify a contract.

An employee whose duties are to develop proper requirements and ensure contractors meet the commitments during contract administration, including the timeliness and delivery of quality goods and services as required by the contract.

A request of GSA where a federal agency retains and manages all aspects of the procurement process and is able to work with the selected vendor after award.

The process of handling real property that is surplus to the federal government’s needs. Federal law mandates the disposal process, which has these major steps (although not every property goes through every step):

An SBA program that gives preferential consideration for certain government contracts to businesses that meet the following eligibility requirements:

See Title 13 Part 127 Subpart B of the Code of Federal Regulations for more information.

A vehicle that is powered by an electric motor drawing current from rechargeable storage batteries or other portable electrical energy storage devices, as defined by 10 C.F.R. § 474.2. It includes a battery electric vehicle, a plug-in hybrid electric vehicle, a fuel-cell electric vehicle, etc.

Also called electric vehicle chargers, this includes EV charge cords, charge stands, attachment plugs, vehicle connectors, and protection, which provide for the safe transfer of energy between the electric utility power and the electric vehicle.

The primary regulation for federal agencies to use when buying supplies and services with funds from Congress.

Use acquisition.gov to browse FAR parts or subparts or download the full FAR in various formats.

The travel and relocation policy for all federal civilian employees and others authorized to travel at government expense.

A program that promotes the adoption of secure cloud services across the federal government by providing a standardized approach to security and risk assessment.

A GSA business line that provides safe, reliable, low-cost vehicle solutions for federal agency customers and eligible entities. Offerings include:

A charge card for U.S. government personnel to use when paying for fuel and maintenance of GSA Fleet vehicles. Find out where the Fleet card is accepted, how to use it and more.

A Department of Homeland Security program that allows members to use expedited lanes at U.S. airports and when crossing international borders by air, land and sea.

A charge card for certain U.S. Government employees to use when buying mission-related supplies or services using simplified acquisition procedures, when applicable, and when the total cost does not exceed micro-purchase thresholds.

A charge card for U.S. government personnel to use when paying for reimbursable expenses while on official travel. Visit smartpay.gsa.gov for more.

A vehicle used to perform an agency’s mission(s), as authorized by the agency.

A pre-competed, multiple-award, indefinite delivery, indefinite quantity contract that agencies can use to buy total IT solutions more efficiently and economically.

A ceremony marking the official start of a new construction project, typically involving driving shovels into ground at the site.

An online shopping and ordering system at gsaadvantage.gov that provides access for federal government employees and in some cases, state and local entities, to purchase from thousands of contractors offering millions of supplies and services.

An online auction site at gsaauctions.gov that allows the general public to bid on and buy excess federal personal property assets such as:

Real property for which GSA is responsible. It can be either federally owned or leased from a public or private property owner.

An SBA program that gives preferential consideration for certain government contracts to business that meet the following eligibility requirements:

See Title 13 Part 126 Subpart B of the Code of Federal Regulations for more information.

A type of contract when the quantity of supplies or services, above a specified minimum, the government will require is not known. IDIQs help streamline the contract process and speed service delivery.

A fee paid by businesses who are awarded contracts under Multiple Award Schedule to cover GSA’s cost of operating the program. The fee is a fixed percentage of reported sales under MAS contracts that contractors pay within 30 calendar days following the completion of each quarter.

A law that provides $3.375 billion for us to:

This includes $2.15 billion for low embodied carbon materials in construction projects, $975 million to support emerging and sustainable technologies, and $250 million for measures to convert more buildings into High Performance Green Buildings.

A written agreement entered into between two federal agencies, or major organizational units within an agency, which specifies the goods to be furnished or tasks to be accomplished by one agency (the servicing agency) in support of the other (the requesting agency).

A facility, also known as a border station, that provides controlled entry into or departure from the United States for persons or materials. It houses the U.S. Customs and Border Protection and other federal inspection agencies responsible for the enforcement of federal laws related to entering into or departing from the U.S.

An employee who is responsible for preparing, negotiating, awarding and monitoring compliance of lease agreements.

Criteria used to select the technically acceptable proposal with the lowest evaluated price. Solicitations must specify that award will be made on the basis of the lowest evaluated price of proposals meeting or exceeding the acceptability standards for non-cost factors.

The rate of reimbursement for driving a privately owned vehicle when your agency authorizes it. Current rates are at gsa.gov/mileage.

Long-term governmentwide contracts with commercial firms providing federal, state, and local government buyers access to more than 11 million commercial products and services at volume discount pricing. Also called Schedules or Federal Supply Schedules.

The standard federal agencies use to classify business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy.

A family of seven separate governmentwide multiple award, IDIQ contracts for program management, management consulting, logistics, engineering, scientific and financial services.

A formal, signed agreement between GSA’s Public Buildings Service and a federal agency for a specific space assignment.

Services performed under a contract with a federal agency that include:

Official verification of someone’s origin, identity, and nationality. A U.S. passport is required of U.S. citizens for international travel and reentry into the United States. There are three types of passports: diplomatic, official, and regular. A government official may have at the same time a valid regular passport and a valid official or diplomatic passport. Use GSA Form 2083 to begin a request for an official passport.

The per day rates for the lower 48 continental United States, which federal employees are reimbursed for expenses incurred while on official travel. Per diem includes three allowances:

An identification card that allows credentialed government personal to access facilities, computers, or information systems. May also be referred to as HSPD-12 card, LincPass, Smart Card, or CAC.

Furniture and equipment such as appliances, wall hangings, technological devices, and the relocation expenses for such property.

Information that can be used to distinguish or trace an individual’s identity, either alone or when combined with other information that is linked or linkable to a specific individual. Get more info from OMB Circular A-130 [PDF].

You should only drive a privately owned vehicle for official travel after your agency evaluates the use of:

When your agency has determined a POV to be the most advantageous method of transportation, you are authorized reimbursement for mileage and some additional allowances (parking, bridge, road and tunnel fees, etc.).

Approvals from GSA’s congressional authorizing committees, the U.S. Senate Committee on Environment and Public Works and the U.S. House Committee on Transportation and Infrastructure, for proposed capital and leasing projects that require funding over an annually established threshold.

Region 1 (New England): Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont

Region 2 (Northeast and Caribbean): Northern New Jersey, New York, Puerto Rico, U.S. Virgin Islands

Region 3 (Mid-Atlantic): Delaware, parts of Maryland, Southern New Jersey, Pennsylvania, parts of Virginia, West Virginia

Region 4 (Southeast Sunbelt): Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee

Region 5 (Great Lakes): Illinois, Indiana, Michigan, Minnesota, Ohio, Wisconsin

Region 6 (Heartland): Iowa, Kansas, Missouri, Nebraska

Region 7 (Greater Southwest): Arkansas, Louisiana, New Mexico, Oklahoma, Texas

Region 8 (Rocky Mountain): Colorado, Montana, North Dakota, South Dakota, Utah, Wyoming

Region 9 (Pacific Rim): Arizona, California, Hawaii, Nevada

Region 10 (Northwest Arctic): Alaska, Idaho, Oregon, Washington

Region 11 (National Capital): Washington, D.C., area including parts of Maryland and Virginia

Formal agreements between GSA and a federal agency customer where GSA agrees to provide goods, services, or both, and the federal agency agrees to reimburse GSA’s direct and indirect costs. The customer portal for RWA information is called eRETA at extportal.pbs.gsa.gov.

A document used in negotiated procurements to communicate government requirements to prospective contractors (firms holding Multiple Award Schedule contracts) and to solicit proposals (offers) from them.

A document used to communicate government requirements, but which do not solicit binding offers. Quotations submitted in response are not offers. The Multiple Award Schedule order is the offer, and then the contractor can do something to show acceptance, like ordering supplies or contacting subcontractors.

An SBA program that gives preferential consideration for certain government contracts to businesses that meet the following eligibility requirements:

See Title 13 Part 125 Subpart B of the Code of Federal Regulations for more information.

An SBA designation for businesses that meet size standards set for each NAICS code. Most manufacturing companies with 500 employees or fewer, and most non-manufacturing businesses with average annual receipts under $7.5 million, will qualify as a small business.

See Title 13 Part 121.201 of the Code of Federal Regulations for more information.

To improve and stimulate small business utilization, we award contracts to businesses that are owned and controlled by socially and economically disadvantaged individuals. We have contracting assistance for:

A Small Business Administration program that gives preferential consideration for certain government contracts to business that meet the following eligibility requirements:

See Title 13 Section 124.1001 of the Code of Federal Regulations for more information.

The basis for the lease negotiation process, which becomes part of the lease. SFOs include the information necessary to enable prospective offerors to prepare proposals. See SFO minimum requirements.

Specific supply and service subcategories within our Multiple Award Schedule. For the Information Technology Category, a SIN might be new equipment or cloud services.

A national policy committing to create and maintain conditions under which humans and nature can exist in productive harmony to support present and future generations.

An online system at sam.gov, which the U.S. Government uses to consolidate acquisition and award systems for use by contractors wishing to do business with the federal government. Formerly known as FBO.gov, all contracting opportunities valued over $25,000 are posted at sam.gov.

When you use a government purchase card, such as the "GSA SmartPay" travel card for business travel, your lodging and rental car costs may be exempt from state sales tax. Individually billed account travel cards are not tax exempt in all states. Search for exemption status, forms and important information.

The finishes and fixtures federal agency tenants select that take a space from a shell condition to a finished, usable condition and compliant with all applicable building codes and standards.

A statute that applies to all Multiple Award Schedule contracts, unless otherwise stated in the solicitation or contract, which requires contractors to sell to the U.S. Government only products that are manufactured or “substantially transformed” in the U.S. or a TAA-designated country.

An option for vendors to report transactional data — information generated when the government purchases goods or services from a vendor — to help us make federal government buying more effective.

See our TDR page for which SINs are eligible and which line-item data to submit.

A unique number required to do business with the federal government.

An indicator of how efficiently a federal agency is currently using space, it is traditionally calculated by dividing the usable square feet of the space, by the number of personnel who occupy the space.

A Small Business Administration program that gives preferential consideration for certain government contracts to businesses that meet the following eligibility requirements:

A governmentwide acquisition contract exclusively for service-disabled veteran-owned small businesses to sell IT services such as:

The amount of solid waste, such as trash or garbage, construction and demolition waste, and hazardous waste, that is reused, recycled or composted instead of being put in a landfill or burned.

A GSA program designed to promote recycling and reuse of solid waste.

A Small Business Administration program that gives preferential consideration for certain government contracts to businesses that meet the following eligibility requirements:

See Title 13 Part 127 Subpart B of the Code of Federal Regulations for more information.

Vehicles that, when operating, produce zero tailpipe exhaust emissions of any criteria pollutant (or precursor pollutant) or greenhouse gas. These include battery and fuel cell electric vehicles, as well as plug-in hybrid vehicles that are capable of operating on gas and electricity. They also may be called all-electric vehicles.